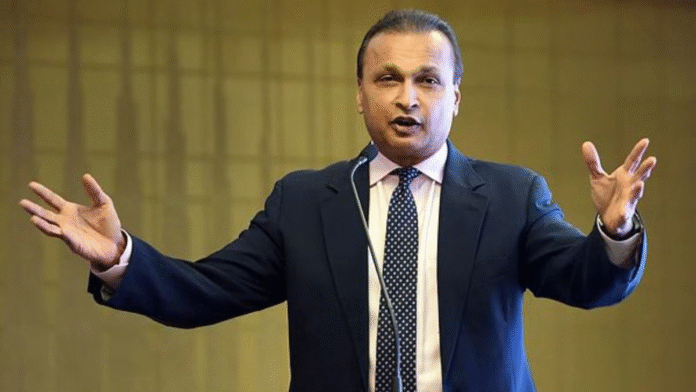

The Central Bureau of Investigation (CBI) on Saturday registered a case against industrialist Anil Ambani and carried out searches at his residence as well as the premises of Reliance Communications Ltd. in connection with an alleged bank fraud that caused a loss of over ₹2,929 crore to the State Bank of India (SBI).

ALSO READBank fraud case: After ED, CBI raids properties linked to Anil Ambani in Mumbai

The action came days after the Enforcement Directorate (ED) questioned Ambani in a separate case and filed a money laundering complaint against his group companies. The CBI had obtained search warrants from a Mumbai court on Friday.

SBI’s Complaint Triggers Probe

“The Central Bureau of Investigation has registered a criminal case on August 21 against M/s Reliance Communication Ltd. (RCOM), Mumbai, its Director Anil D. Ambani, unknown public servants and unknown others on the allegations of defrauding the bank, and thereby causing wrongful loss of Rs 2929.05 crore to the bank,” a CBI spokesperson said in a statement.

On August 18, the CBI received a complaint from Jyoti Kumar, Deputy General Manager of SBI’s Mumbai branch. According to Kumar, the fraud was detected after a forensic audit report was submitted on October 15, 2020, covering the period from April 1, 2013 to March 31, 2017.

“The fraud has taken place at Mumbai in credit facilities availed by borrower company, wherein the accused persons/company in conspiracy with each other and unknown others have induced the lenders to avail the credit facilities by misrepresentation and deception and after disbursal of the same, misappropriated the funds of the Banks by entering into transaction which were in violation of the terms and conditions of sanction of the credit facilities,” Kumar alleged in his complaint.

Allegations of Diversion and Misuse of Funds

The CBI said the allegations include misuse and diversion of funds across group companies and associates.

The spokesperson noted: “It is alleged that the accused in criminal conspiracy, misrepresented and got sanctioned credit facilities from SBI in favour of Reliance Communications.”

ALSO READWhat is Dream Money? Dream11 parent launches new finance app for gold, SIPs and FD investment

“Further, the allegations pertain to misutilization/diversion of loan funds, potential routing of loan funds,

» Read More