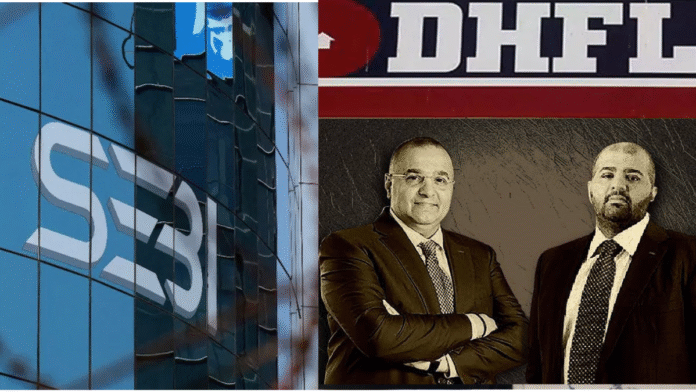

Capital markets regulator SEBI has banned Dewan Housing Finance Corporation Ltd’s former Chairman and Managing Director, Kapil Wadhawan, ex-director Dheeraj Wadhawan, and four others from the stock markets for up to five years and slapped a penalty of Rs 120 crore on them for diverting funds and fabricating books.

They have also been barred from holding any key position in a listed company for up to five years.

What did the SEBI investigation reveal?

According to the SEBI investigation, the main culprits involved in the fraudulent scheme were Kapil Wadhawan and his brother Dheeraj, who have been fined Rs 27 crore each. Rakesh Wadhawan, who was Non-Executive Chairman, and Sarang Wadhawan, a former Non-Executive Director, were also involved through their roles on DHFL’s board and face penalties of Rs 20.75 crore each. Besides, Harshil Mehta, who was Joint Managing Director & CEO and Santosh Sharma, a former CFO of the company, have been fined Rs 11.75 crore and Rs 12.75 crore, respectively.

What did SEBI state in its order?

The SEBI has stated in its order that since 2006, DHFL, along with its promoters, directors, and key managerial personnel, have engaged and participated in an “egregiously fraudulent scheme” to divert funds to “Bandra Book Entities” (BBEs) linked to the promoters. DHFL’s loans to BBEs rose to a staggering Rs 14,040.5 crore by March 31, 2019.

ALSO READWhat is algorithmic trading? SEBI proposes new definition and changes to broker rules

The order states that the promoters issued huge unsecured loans to these entities despite the fact that they did not have any assets or business. These loans were also falsely recorded as retail housing loans.

The investigation has found that the modus operandi involved was to first extend large unsecured loans to these BBEs, even though they had no net worth, assets, or cash flows to justify such exposure. Second, all standard loan appraisal processes were deliberately bypassed.

Third, these weak intercorporate loans to related parties were misrepresented as retail housing loans, creating a false impression of the company’s financial health for investors and other stakeholders.

“To effect this elaborate deception, a fake virtual branch (‘Bandra branch’) and previously closed retail loan accounts were employed, alongside three different accounting software, camouflaging the BBE loans as retail housing loans. In the initial years,

» Read More