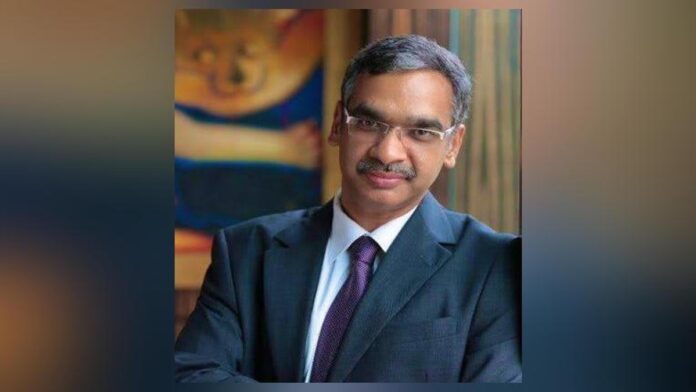

American fried-chicken chain Popeyes, whose India franchise is with Jubilant FoodWorks, will five new stores in Mumbai as part of its store expansion plan. The brand aims to touch 250-outlets in the next 3-4 years from 63 stores now. Sameer Khetarpal, Jubilant FoodWorks MD & CEO tells Viveat Susan Pinto how the firm is differentiating Popeyes from its nearest competitor KFC. He also throws light on how Jubilant FoodWorks is driving value across delivery and dine-in operations and the company’s investment in technology. Excerpts:

What is the reason behind launching five Popeyes stores in quick succession in Mumbai?

Mumbai is an important market and also a competitive one. Popeyes is currently present in 23 cities including metros with 63 stores. We were clear we didn’t want to miss out on the Mumbai market, which is an important consumption centre. The journey to get here with Popeyes started almost a year ago in terms of identifying the properties and catchments we wanted to target. Three Popeyes stores have been launched on Wednesday and another two will come up in the next one month. We want to grow Popeyes into a Rs 1,000-crore brand in the next three years. A rapid store rollout strategy will help us achieve this objective.

Apart from Popeyes, are there any more Rs 1,000-crore bets that you are incubating at Jubilant FoodWorks?

We are clear that we are serving joy on a plate. Our bets are based on deep consumer insights. For instance, we find that customers order Domino’s due to their craving for cheese. We have responded to this with a strong menu around cheese. For instance, we launched Cheese Volcano, which was a hit with customers. We then launched Cheese Burst in three new flavours. We continue to add to the cheese line-up we have at Domino’s. I genuinely believe that cheese can become a Rs 1,000-crore platform. Similarly, we have introduced chicken wings at Domino’s, which can also become a Rs 1,000-crore bet. The post 11 pm eating time, which is a culture that we find growing in India, is also a platform that we believe can be expanded into a Rs 1,000-crore bet in the future.

ALSO READ‘I don’t want to get into a bidding war with the big boys in cement space,’ says Parth Jindal How are you driving value across delivery and dine-in operations? » Read More