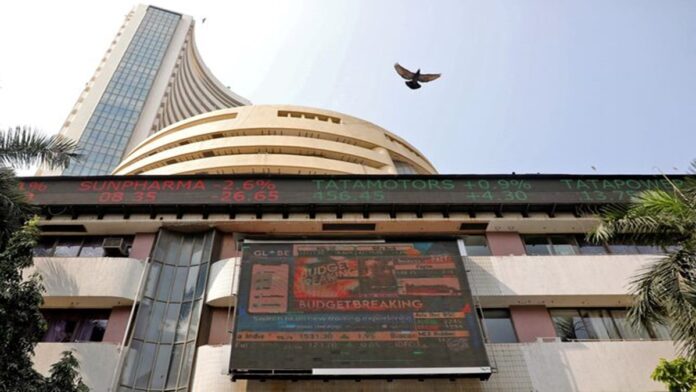

The Indian stock market closed lower today as both benchmark indices, Sensex and Nifty, ended the trading session in negative territory. The Sensex settled at 83,516.96 falling by 195.55 points or 0.23%, while the Nifty wrapped up at 25,476.10, down by 46.40 points or 0.18%. The Nifty Bank index also slipped, closing at 57,213.55, a decline of 0.07%.

“Indian key indices remained largely range-bound, while domestic consumption themes continued to anchor investor sentiment. Early commentary from FMCG and discretionary players suggests green shoots of recovery, supported by easing inflation, a healthy monsoon, and rising rural demand. Despite global trade tensions and commodity tariffs, investor focus is increasingly shifting toward domestic earnings and structural growth drivers, including a likely sequential recovery in urban demand and a pickup in infrastructure-led spending,” said Vinod Nair, Head of Research, Geojit Investments.

Here’s a quick look at the key highlights from today’s market action:

Top gainers

Among the top performers in today’s trade from the Sensex 30 pack were Bajaj Finance, Hindustan Unilever, Ultratech Cement, Mahindra & Mahindra, and ITC among other stocks.

Key laggards

On the flip side, several heavyweight counters came under selling pressure. The major laggards included HCL Tech, Tata Steel, Tech Mahindra, Reliance Industries, and Bharat Electronics.

ALSO READStocks making the biggest moves midday: HCL Tech, HUL, Vedanta, Phoenix Mills and more Top Index Performers

In the sectoral indices, BSE FMCG and BSE Consumer Durables emerged as the top-performing sectors. The BSE SmallCap and BSE 250 SmallCap indices also ended higher. Interestingly, the BSE IPO index joined the winners.

Top sectors in Wednesday’s trade

Tyres, electronics, fertilisers, and leather sectors were among the top gainers in trade today. The tyres sector led the pack with a gain of 2.12%, followed closely by electronics, which rose 1.89%. Fertilisers also saw healthy traction with a 1.83% rise, while the leather sector added 1.75%.

ALSO READVedanta in focus: Short seller Viceroy says ‘Group structure financially unsustainable, resembles a Ponzi scheme’; Vedanta responds Best and worst performing business groups

Several business groups saw notable movements in market cap today. On the gaining side, Emami Group led with a 6.31% rise, followed by Jaipuria Group at 4.58%, Nagarjuna Group at 4.24%, and Indiabulls Group with a 3.1% uptick.

» Read More