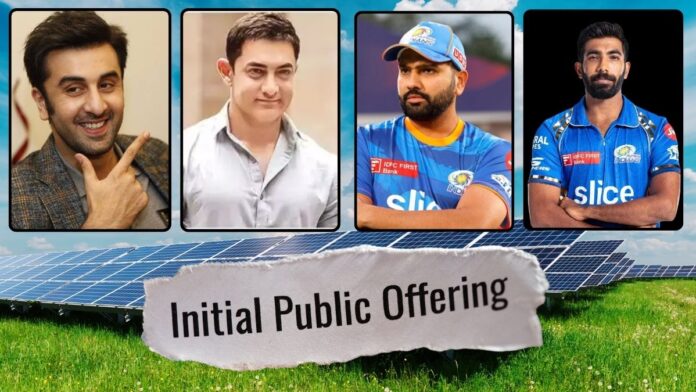

When solar and transmission line gearmaker Karamtara Engineering gears up for its IPO, it is not just the market watchers who are paying attention. In fact, bollywood and cricket stars are also in action too.

Big names like Ranbir Kapoor, Aamir Khan, Karan Johar, Rohit Sharma, and Jasprit Bumrah have backed the company with multi crore investments to the upcoming public issue.

Let’s take a look look at the interesting things about Karamtara IPO plans-

Karamtara IPO: Celebs bet big on clean energy tech

On April 25, film stars and cricketers collectively picked up nearly Rs 30 crore worth of shares in Karamtara Engineering via secondary market transactions. These included Ranbir Kapoor, Aamir Khan, Karan Johar, Rohit Sharma, and Jasprit Bumrah, along with Bimal Parekh. They bought 9.68 lakh shares at Rs 310 apiece, valuing the company at around Rs 10,411 crore post-issue.

ALSO READWhy SEBI sounded the alarm on opinion trading apps Karamtara IPO size and purpose

The Mumbai based company is looking to raise Rs 1,750 crore through its IPO, which includes Rs 1,350 crore via a fresh issue and Rs 400 crore through an OFS. According to the draft papers, promoters Tanveer Singh and Rajiv Singh will offload Rs 200 crore worth of shares each in the OFS.

Karamtara IPO: Debt reduction a priority

As per the DRHP, Karamtara plans to use Rs 1,050 crore out of the fresh issue proceeds to pare down its debt. As of November 2024, the company’s borrowings stood at Rs 586.4 crore, along with Rs 733.6 crore in acceptances via letters of credit. The rest of the funds will go towards general corporate purposes.

ALSO READAther Energy IPO: 5 reasons why investors are staying away Karamtara IPO: Previous fundraising rounds drew marquee names

Before this celebrity led buzz, the company had already raised Rs 307 crore in January 2024 through a preferential allotment. Investors included Singularity Growth Opportunities Fund, Quantum State Investment Fund, Ananta Capital, and Gaurav Trehan, among others, all at the same Rs 310 per share price.

About the company

Karamtara Engineering is a backward integrated manufacturer with a presence in the solar and transmission space. It competes with firms like Inox Wind,

» Read More