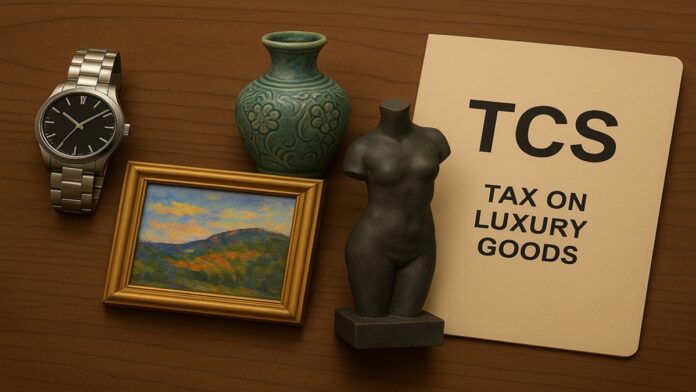

Now, you will have to pay 1% TCS (tax collected at source) on the purchase of luxury goods like handbags, wrist watches, footwear, high-end sportswear and art objects costing more than Rs 10 lakh.

The Income Tax Department has issued a notification stating that 1% TCS will be imposed on sale of certain luxury goods priced above Rs 10 lakh. This is effective from April 22, 2025.

The government introduced the TCS provision for luxury goods via Finance Act, 2024, as part of the Union Budget presented last year in July.

As regard the operationalisation of the new rules, sellers will have to deduct TDS on sale of the notified goods such as wrist watch, art objects such as paintings, sculptures, and antiques, collectible items including coins and stamps, yachts, helicopters, luxury handbags, sunglasses, footwear, high-end sportswear and equipment, home theatre systems, and horses intended for racing or polo.

The government in the February Budget announced many important changes related to tax, especially to make TDS and TCS easy and simple. The purpose of these changes – which became effective from April 1, 2025 – was to make tax compliance easier for common taxpayers and traders and eliminate unnecessary complexities.

» Read More