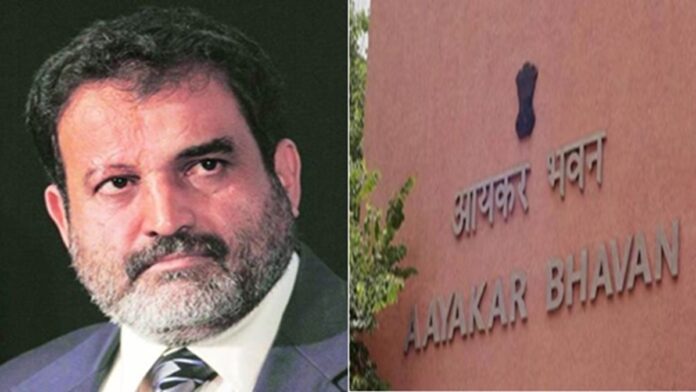

T V Mohandas Pai, former CFO and board member at Infosys, has once again slammed tax authorities and the central as well as state governments for “oppressing” taxpayers and hounding them with “tax terrorism”.

Tax terrorism refers to a situation when the process of tax collection becomes so complex and harsh that ordinary citizens get unnecessarily harassed.

Stating that he has seen “regulatory oppression” by successive governments at the Centre and state level for decades, the IT industry veteran said one set of imperialists left this country after Independence in 1947 but another set of brown imperialists took over.

This is not the first time Pai has spoken on this matter. Earlier also on several occasions, he raised such governance and tax issues, taking on the central and state governments.

“Today, Rs 30 lakh crore of tax is stuck in disputes, of which Rs 15 lakh crore is in court. 80-85 percent of these incidents have happened in the last five years,” Pai said during a panel discussion at the Rising Bharat Summit 2025, held in Delhi.

Also read: ‘Assault on our rights…get a court order’, Mohandas Pai blasts rule allowing tax officials track e-mails, social media accounts

Pai said he has been in the business for the last 40 years and has faced “regulatory oppression” over these years. “We are the subjects and victims of the government in Delhi, Bangalore and elsewhere, because they think they are the rulers and we are their subjects and victims. And that translates into regulations,” he said.

Pai recalled when Arun Jaitley promised in 2014 that he would stop “tax terrorism”. He said that unfortunately, the government has given “more powers to tax officials” to put pressure on taxpayers.

Pai also said that the government has collected Rs 75 lakh crore in direct tax in the last four years, but questioned how much black money has been seized.

“In the last four years, we collected Rs 75 lakh crore in direct tax. How much black money have they found? How much tax have they collected for black money? We have been suffering angel tax for 8 years…every time they make a new law, they give more powers to tax officials.”

Also read: ‘Where is the capital?’ Mohandas Pai fires back after Goyal’s critique of food,

» Read More