Tier 2 and Tier 3 cities in India are rapidly emerging as new growth hubs, attracting both homebuyers and real estate developers seeking opportunities beyond the saturated metro markets. Their rising appeal lies in a combination of affordability, improved infrastructure, and evolving urban lifestyles. As property prices continue to soar in metropolitan areas, buyers are increasingly drawn to the more spacious and cost-effective housing options these emerging cities offer.

As per a CREDAI-Liases Foras research report on the real estate sector of 60 Indian cities, as many as 44% of the 3,294 acres of land acquired by real estate developers in 2024 were concentrated in the emerging hubs of India’s Tier-2 and Tier-3 cities. The report said housing sales in 2024 reached 681,138 units across 60 cities, recording a 23% Y-o-Y increase. The primary developers’ market registered a sales value of Rs 7.5 trillion, reflecting a staggering 43% YoY growth, propelled by sustained demand across segments.

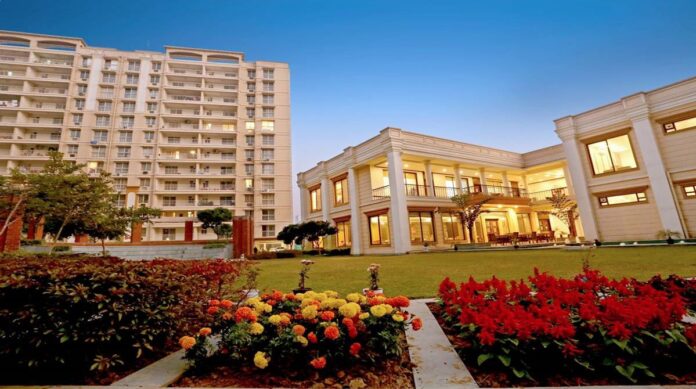

Notably, the luxury and ultra-luxury segments dominated the market, contributing to 71% of the total sales value. This surge in high-end property transactions highlights a shift in buyer preferences toward premium living spaces, driven by rising incomes and aspirations. Further, properties priced between Rs 1–2 crore saw a 52% jump in sales, with 1,32,532 apartments sold in 2024, while the ultra-luxury segment (Rs 2 crore+) witnessed a steep rise of 73%. The swift expansion of infrastructure in Tier-2 and Tier-3 cities is also playing a pivotal role in driving luxury real estate growth.

Also Read: Strategic Asset Allocation: A smarter way to weather market volatility

Deepak Kapoor, Director, Gulshan Group, says, “Luxury living is no longer restricted to metro cities. Tier 2 cities are increasingly emerging as the new frontiers of growth, driven by their proximity to Delhi-NCR and the growing pool of high-net-worth individuals who are seeking quality living spaces that are on par with global lifestyle standards. Thus, with an increasingly affluent population and a robust demand for luxury living, these cities are well-positioned to attract significant investment in the coming years.”

Moreover, post-pandemic, the rise of remote and hybrid work models has significantly influenced homebuyer preferences, driving demand for larger homes in Tier 2 and 3 cities. Professionals are prioritizing spacious residences with better amenities, seeking a balance between work and lifestyle away from the congestion of metros.

» Read More