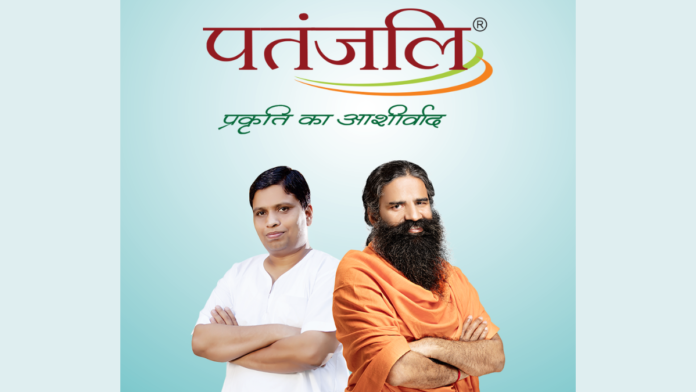

Baba Ramdev-owned Patanjali Ayurved has expanded its business footprint by acquiring a majority stake in Magma General Insurance. This strategic move marks Patanjali’s entry into the competitive general insurance sector, further diversifying its portfolio beyond its established Ayurvedic, wellness, and consumer goods offerings, reports CNBC TV18.

Following the acquisition, Patanjali Ayurved will become the promoter entity of Magma General Insurance. This significant restructuring is poised to reshape the Indian insurance landscape and reflects Patanjali’s ambition to broaden its business horizon.

ALSO READ‘Tariff terrorism’: Baba Ramdev slams Donald Trump trade tariffs, warns of ‘intellectual colonization’

Transaction Partners

The sellers in this transaction comprise several notable entities. The most significant among them is Senoti Properties, a joint venture between businessman Adar Poonawalla and Rising Sun Holdings, which held a 74.5 per cent stake in Magma General Insurance prior to the deal.

ALSO READRelief for Patanjali Foods: Supreme Court quashes Rs 186 crore tax demand

Other selling entities include: Celica Developers, Jaguar Advisory Services, Keki Mistry, Atul DP Family Trust, Shahi Sterling Exports and QRG Investments & Holdings.

» Read More