Goldman Sachs has reduced its 12-month target for the Nifty by around 5.6% to 25,500 from the previous target of 27,000, representing around 12% potential upside from Monday’s level of 22,460.

Goldman’s three-month target for the NSE benchmark is 23,000 and it expects the indice to touch 24,000 in the next six months.

ALSO READAfter Goldman Sachs, Nuvama cuts target price for BSE. 3 big worries are…

Local headwinds are stabilising for Indian stocks, but the volatility may remain high near-term, given heavy ownership of small- and mid-cap shares by domestic investors and lingering global uncertainty, the global brokerage said.

It has maintained a ‘marketweight’ position on India, having downgraded it from ‘overweight’ in October 2024, citing a cyclical slowdown in economic growth and corporate profits.

The brokerage has said its economists think the GDP growth has bottomed out, but the recovery is likely to be gradual. “The recently reported Q4CY24 real GDP growth showed a recovery to 6.2% YoY, from a seven-quarter low of 5.6% YoY in Q3CY24, driven by an improvement in private consumption growth, while investment growth remained subdued,” it said. Looking forward, the quarterly real GDP projections show the growth hovering between 6% and 6.7% on a year-on-year basis over the next four quarters, with full year CY25 growth forecast being 6.4%.

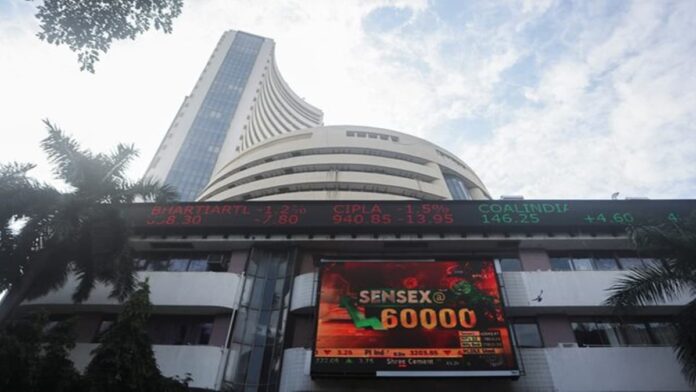

The EPS downgrade cycle is not over, but the pace of cuts has moderated, as performance for the December quarter has been slightly better than already lowered expectations, Goldman said. “Market technicals suggest signs of bottoming out for Indian equities, as the Nifty 50 has posted declines for five consecutive months and corrected 14% from the September peak.”

Three reasons why the market is falling today: BSE Small Cap Index down 2%

Goldman said the earnings sentiment for the BSE 200 index has worsened to two-year lows and the third quarter results missed consensus expectations by 4 percentage points.

Among sectors, Goldman Sachs continues to favour information technology, consumer staples, automobiles, telecommunications, internet services, and insurance.

» Read More