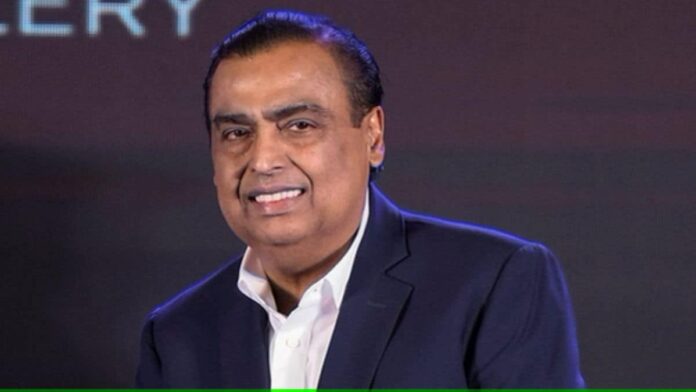

Former President of Reliance Industries, Captain Raghu Raman, shared his unfiltered thoughts on Mukesh Ambani’s vision and leadership skills. In a post shared by RPG Group Chairperson Harsh Goenka on X (formerly Twitter), Raman said, “The one leader whose vision and thinking truly dwarf me is Mukesh Ambani.” In the clip, Raman shared an insight into what makes Ambani ‘so incredibly successful’.

In the clip from the podcast shared by Harsh Goenka, Raman said that one of the very strong reasons why leaders like Mukesh Ambani are able to attract and more importantly, retain talent is because they have been trained to be the leaders since their childhood.

ALSO READInfosys rolls out salary increments for employees, lowest is 5%

Sharing an incident that had left him in awe of Mukesh Ambani, Raman said, “This was around the year 2017-18 when drones were supposed to be coming into commercial usage. I didn’t want to go to him after an order had come and then say that we are working on the plans. So I made the plans and went to him. He listened to me for a couple of minutes and then he started rummaging in his drawers and then he took out a sheet and placed it and said ‘lets buy a satellite. There’s a $400 million offer from Ukraine for a satellite, let’s buy it’.”

Raman said that had this come from any other leader, he would have ‘discounted it as fuzz’, but since it came from Mukesh Ambani, he was completely surprised and in awe of the grandiosity of the vision. “Here I was thinking of a drone and he was thinking of satellites. The difference in altitude will kind of tell you that he is a special person who has cultivated the ability. Some of the elements of leadership which many of these leaders have is not intuitive. They are cultivated,” he added.

» Read More