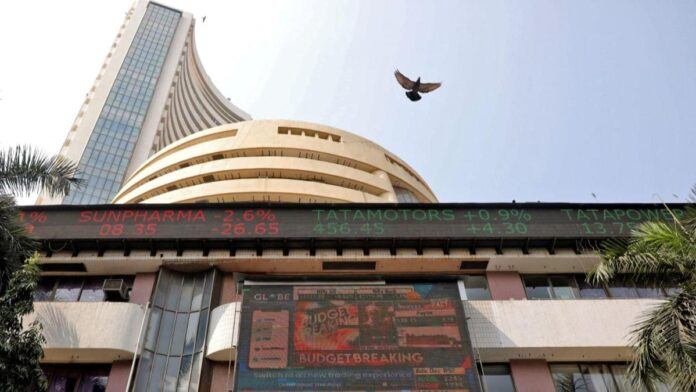

The Indian stock market wrapped up on a flat note today, February 25.

The BSE Sensex added 147.71 points (0.20%) to settle at 74,602.12, maintaining a positive streak. Meanwhile, the NSE Nifty slipped 5.80 points (0.03%), ending at 22,547.55.

Among the Nifty stocks, Mahindra & Mahindra (M&M), Bharti Airtel, Bajaj Finance, Maruti Suzuki, and Nestle emerged as top gainers. On the flip side, Hindalco, Dr Reddy’s Labs, Sun Pharma, Hero MotoCorp, and Trent dragged the index down.

Market Holiday on February 26

Investors will have a break on February 26, as the stock market will remain closed for Mahashivratri. Trading will resume on February 27.

This is a developing story, more details are being added. Please watch the space for updates

» Read More