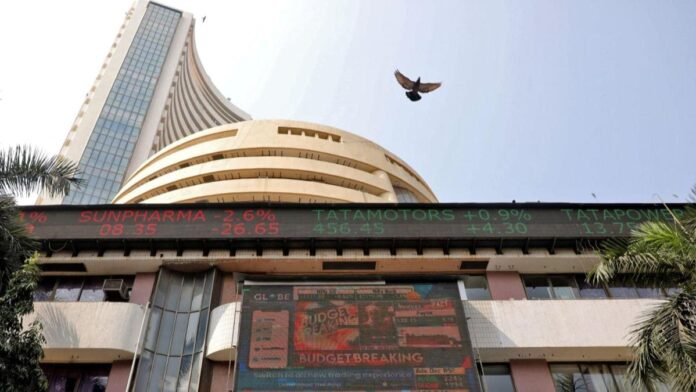

2025 has been tough for the Indian stock market, given the persistent selling, leading to a severe correction. This has been fueled by several factors, starting with the rupee depreciation, high market valuations, and a slowdown in earnings.

Moreover, foreign investors (FIIs) have been selling persistently due to the strong dollar, high bond yields, and uncertainties over Trump’s policies.

The combination of these factors has created a challenging market environment, which, based on the December quarter results, is likely to persist.

In these circumstances, investors tend to prefer dividend investing.

ALSO READMidcap index forms Bullish Reversal pattern. Two stocks in focus…

Stocks that pay consistent dividends tend to exhibit low volatility. They provide a steady income stream and the potential for capital appreciation.

Some stocks even increase dividends intermittently, providing investors with steady income growth.

Nevertheless, not all companies consistently pay or increase dividends. Identifying those with a track record of regular payments and steady dividend growth is essential.

In this editorial, we’ve shortlisted 5 stocks that have increased dividends in the past few quarters. At their current market price, these stocks also pay higher dividend yields.

These stocks are a way to obtain passive income, and they should be on your watchlist.

#1 Indian Oil Corporation

First on the list is Indian Oil Corp (IOC).

IOC is India’s largest oil marketing company (OMC) and third-largest oil and gas company.

The company operates 11 of India’s 23 refineries, collectively holding a refining capacity of 80.7 million tonnes per annum (MTPA). It has a global presence in over 70 countries.

As a public sector company (PSU), IOC has a rich legacy of paying consistent dividends and increasing them.

It paid a total dividend of Rs 11.7 per share in FY24, translating into a dividend yield of 7.2%. The dividend payout ratio for the year was 38.3%

In addition, it increased its per share dividend to Rs 7 in the fourth quarter of FY24 from Rs 5 in Q2 FY23.

Over the last 5 years, IOC has averaged a dividend payout of 87% and an average dividend of Rs 8 per share.

» Read More