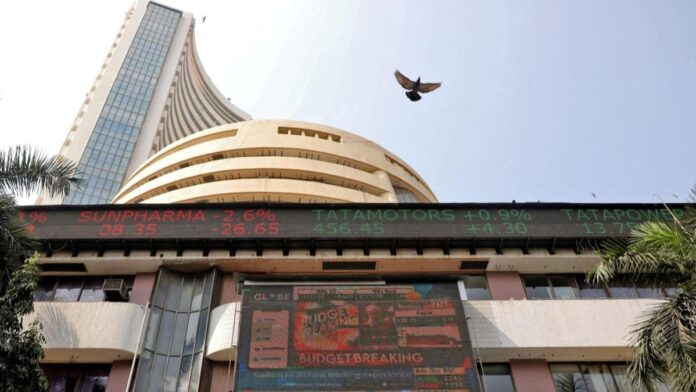

The stock market remains in a panic mode, with the Sensex tanking nearly 2,300 points or 2.83% while Nifty losing 712 points or 3.03% in February alone. In a massive selloff, investors’ wealth has eroded by `21.8 lakh crore this month alone as concerns over reciprocal tariffs continued to weigh on global and domestic equity markets.

If the downward trend continues for the remaining trading sessions of the month, Nifty is set to log its worst-ever five-month losing streak. From October 2024 to February 2025, the Nifty has fallen by 11.68%. During the same period, the Sensex declined by 10.66%, though it saw a marginal gain in November 2024.

However, the hardest hit have been the broader markets. The BSE Midcap Index has lost 6.32% in February so far and 13.07% in the first two months of 2025. Similarly, the BSE Smallcap Index has plunged 8.21% in February and 16.9% year-to-date in 2025.

While foreign institutional investors (FIIs) have pulled out a staggering $3.1 billion (`27,157 crore), domestic institutional investors (DIIs) have bought shares worth `42,601 crore in February so far.

“Although the market has undergone a healthy correction, uncertainties surrounding the gradual recovery of corporate earnings and ongoing tariff-related risks continue to cast doubt on valuation levels, particularly in the broader market,” said Vinod Nair, head of Research, Geojit Financial Services.

He further noted that India is currently lagging behind its Asian peers, as FII outflows remain high, with the ‘sell India, buy China’ strategy continuing to yield returns for the time being.

Barring metals, all sectoral indices have posted losses this month. Industrials, capital goods, realty, FMCG and power were the worst performers, declining up to 10.2%.

Among Nifty 50 stocks, 39 recorded negative returns in February. Power Grid, BEL, Trent, Hero MotoCorp and M&M were the top losers, while Hindalco Industries, Bajaj Finserv, Shriram Finance, IndusInd Bank and Tata Steel were the top gainers.

On Friday, the Sensex closed at an eight-month low of 75,311.06, falling 424.90 points or 0.56%, marking its fourth consecutive session of decline. The Nifty also ended lower at 22,795.50, down 117.25 points or 0.51%.

» Read More