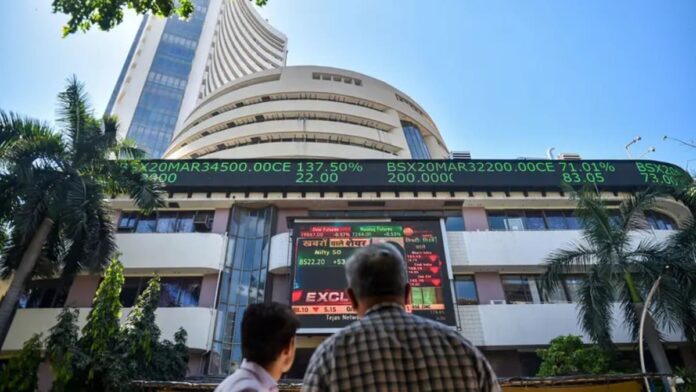

After opening flat, the market turned red in the early trade, with the BSE Sensex slipping 194.98 points or 0.25% to 77,116.82 at 9:25 AM. Meanwhile, the Nifty 50 declined 73.35 points or 0.31%, trading at 23,308.25

The Nifty Bank opened lower on Tuesday, slipping 230.05 points or 0.46% to trade at 49,750.95 in early deals. Weak sentiment also weighed on the Nifty Midcap 100, which dropped 566.85 points to 51,904.20.

The indices opened Tuesday’s trading session on a flat note. The NSE Nifty 50 began the session points or 1.90% higher at 23,383.50 , while the BSE Sensex gained 73.18 points or 0.09% to start at 77,385.

“The nifty fell for a fourth day yesterday – the first time it happened since mid January – and closed at the critical 23381 level. Yesterday, breadth was firmly negative, with nearly 90% of NSE500 stocks ending down, suggesting that weakness persists. Next support on the downside for the nifty sits between 23164 – 23287 while resistance is expected to be offered between 23480 and 24621,” said Akshay Chinchalkar, Head of Research, Axis Securities.

Market Recap: Monday’s performance

On Monday, the BSE Sensex dropped 548.39 points, or 0.70%, to close at 77,311.80. The Nifty 50 also lost momentum, falling 178.35 points, or 0.76%, to settle at 23,381.60.

ALSO READStocks To Watch: Reliance Ind, Grasim Ind, Bata, Titan, ONGC, IHCL, Nykaa, Lupin, Eicher Motors, Ahoka Buildcon

“The significant trend in the ongoing bearish phase of the market is the outperformance of largecaps over the broader market. While the Nifty Midcap and Smallcap indices are down 8.6% and 11.3% respectively YTD, the Nifty is down only 1.52%. This outperformance is likely to continue, going forward,” said Dr. V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

“The relentless selling by FIIs in largecaps has made their valuations fair while the valuations of mid and smallcaps continue to be excessive. FIIs will certainly turn buyers in India; but that will happen only when the dollar index turns weak. We know that it will happen, but don’t know when. What investors have to do now is to buy quality largecaps in banking, IT, autos, pharma and capital goods and wait patiently. When FIIs turn buyers in India,

» Read More