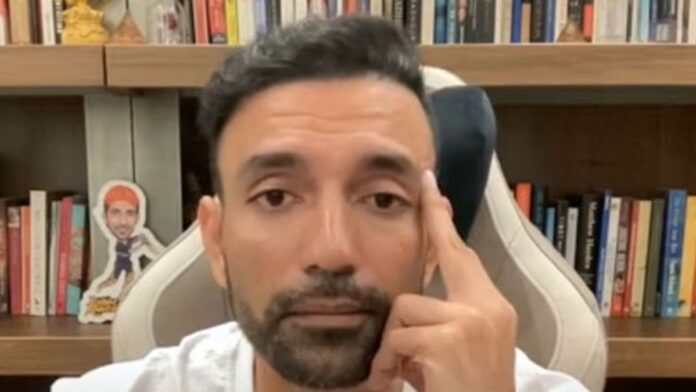

Former India cricketer Robin Uthappa may be arrested in connection with an alleged Provident Fund (PF) fraud case. Uthappa, who is the director of Centaurus Lifestyle Brands Private Limited, is accused of deducting PF contributions from employees’ salaries but failing to deposit the funds into their accounts. The cricketer has allegedly defrauded both the employees and the government.

Centaurus Lifestyle Brands Private Limited is an apparel brand based in Bengaluru. The company allegedly owes Rs 23.36 lakh in damages, which authorities are now trying to recover from Uthappa.

Accused of cheating, Regional Provident Fund Commissioner Shadakshiri Gopala Reddy issued a letter on December 4, 2024, directing the Pulikeshi Nagar Police, Bengaluru to arrest Uthappa.

Also Read Bengaluru Techie Suicide: Allegations of extortion, harassment and legal failings – All you need to know about Atul Subhash’s death Actor Dharmendra summoned by Delhi court in cheating case related to Garam Dharam dhaba franchise Jharkhand: Suspended IAS officer Pooja Singhal granted bail in money laundering case Mumbai police receive death threat against PM Modi, suspect traced to Rajasthan

The police visited Robin Uthappa’s residence to serve a notice, but he was not living at the address. As a result, an arrest warrant has been issued for him. Uthappa now lives in Dubai, as per media reports.

Also read: EPFO: Govt to revise pension for EPS pensioners? Here’s what Centre has to say on revised pension plans

A week ago, the local police received a letter from the PF office requesting the execution of the arrest warrant. Uthappa used to live in an apartment on Wheeler Road in Pulakeshi Nagar. However, when the police visited the address, they discovered he had vacated the property a year ago. The PF office has been informed about this, the local police said.

Reddy’s letter stated that due to the non-payment of dues, the EPFO is unable to settle the Provident Fund accounts of the affected workers.

Here’s what warrant states

“This is to inform you that TK Krishna Das, who is director of M/S Centaurus Lifestyle Brands Pvt Ltd (EST Code (PY/KRP/1524922), addressed at HAL Second Stage in Indiranagar, has failed to remit damages under sections 7A, 14B, and 7Q of the Employees’ Provident Funds (EPF) and Miscellaneous Provisions (MP) Act,

» Read More