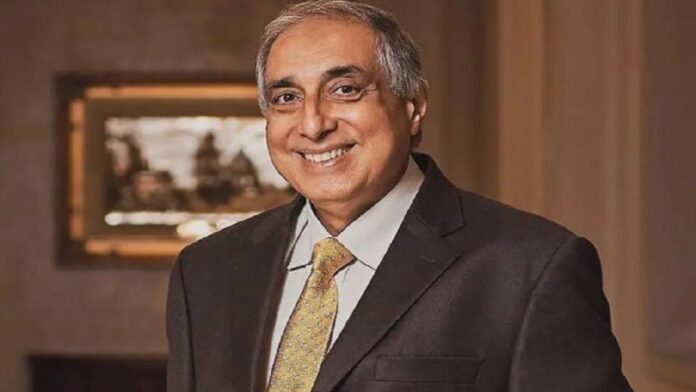

Bengaluru-based Prestige Estates Projects plans to launch multiple projects in Bengaluru, Hyderabad, Mumbai, among others, comprising a total area of 53 million sq ft with total sales value of `52,114 crore by March 2025. In an interview, its chairman and managing director Irfan Razack tells Raghavendra Kamath about the company’s plans and strategy.

Since the RBI is unlikely to cut rates in a hurry, do you expect any headwinds for residential sales in the coming months?

We have had stable home loan rates in the past couple of years and have witnessed a significant momentum in residential demand in this period. So, we do not think that any headwinds shall be there just because of rates being where they are. However, any cut will definitely help the buyers, who are on the fence due to the EMI amounts, to make a favourable decision of buying the house that they want.

Will you be able to meet your annual booking target given that you have seen a fall of 36% in H1?

We are confident of meeting our sales guidance for FY25 on the back of upcoming launches such as The Prestige City in Delhi-NCR, Prestige Southern Star in Bengaluru, Prestige Pallava Gardens in Chennai, Prestige Spring Heights in Hyderabad and Prestige Nautilus in Mumbai. These will provide us the supply to drive sales volumes in H2. The demand remains very strong and all we need to do is get the right product to the market at the right price. Plus the inventory available across our existing projects will also add to the overall sales numbers and will help us achieve our sales guidance for FY25.

What kind of sales you expect from the new launches?

Together, these projects are worth almost `30,000 crore of gross development value and these will drive the sales for the next four months. Another four to five launches are in the works for February and March next year, which will also add to the inventory available for sale for the rest of FY25.

What are the apartment configurations Prestige Estates is focusing on in new launches? Are you also launching plotted developments now?

The apartment configuration and product mix depends on the specific location of the project. Most of our projects are in mid-income housing where two,

» Read More