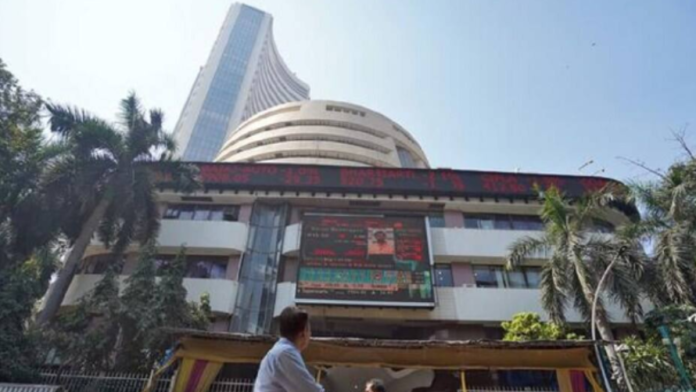

The markets are poised at an interesting juncture. After the dream run in the past year, indices saw some correction recently. But is the worst over? UBS Securities is not hopeful of a repeat of the significant outperformance of the market action seen last year, at least not in the near-term. But IPOs and brisk domestic buying are definitive bright spots for the markets.

The IPO rush and the big domestic investor interest

In an exclusive conversation with Financial Express.com, Sunil Tirumalai, Chief GEM Equity Strategist at UBS Securities highlighted the huge IPO rush that we are seeing in the markets right now – “We haven’t even completed the year, and it’s surprising to see that many IPOs which were supposed to happen next year are now getting pulled forward. Of course, this is causing some strain on the market itself, because you need to find money from somewhere to fund these IPOs.”

Also ReadAdani Group shares jump 8% after Adani Green says “Gautam Adani, Sagar Adani and Vneet Jain not charged with any violation of FCPA”

However, he believes the strong buying by domestic investors has helped in maintaining the balance in markets to a large extent. According to him, one good thing that is really going for India, “is that domestic retail money continues to flow in. When I say retail money, I’m not just talking about people buying stocks on their apps, but also SIPs. The mutual funds eventually find their way into the markets. This has been the strongest positive factor for the markets, and it has held up despite the market correction and foreign selling. As long as this strength and support pillar for the market doesn’t crack, I think it’s okay. The market should be able to withstand it.”

Also Read What are markets watching out for this week? Big cues include elections, FII selling, and global data How US interest rate policies under Trump could shape FII investment in India’s commercial realty? NCR’s High-End Market: How strategic locations drive property value Global cues for markets at this hour – Here are top 5 factors to watch ahead of market opening

The big sectoral bets now

That brings us tothe next question that what should investors bet on? Tirumalai pointed out that capotal goods is one space that he is watching out for.

» Read More