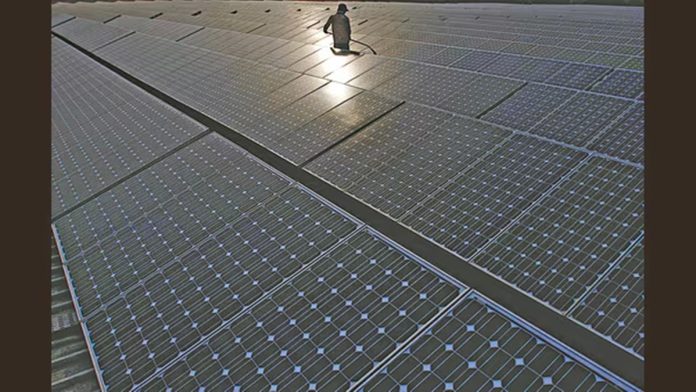

The finances of the state-owned Solar Energy Corporation of India (SECI) has seen a steady and rapid improvement in recent years, with it playing a crucial catalytic role in India’s massive renewable energy drive. Though SECI’s name figured in the US’s department of justice’s indictment of Adani group executives unsealed lately, no specific charge of wrongdoing was made with regard to the firm.

SECI’s revenue from operations grew significantly to Rs 13,035 crore in FY24, up 181.8% from Rs 4,626 crore in FY20. In last five years to FY24, the company saw a jump of 119.8% in its net profit to Rs 510.92 crore.

SECI, the nodal agency for implementing RE projects in the country, over the years have come out with tenders for assorted green energy projects including solar, wind, energy storage, green hydrogen, and hybrid technologies.

Also Read Emaar India to develop Rs 900 cr luxury housing project in Gurugram, eyes Rs 2500 cr topline Raising funds is not difficult for us: O2 Power NTPC Green Energy IPO opens on November 19: Here’s what we know so far Power ministry readies interest subvention scheme for MSMEs

Also ReadAccelerating ROI from technology investment: How to strike a balance between efficiency and long-term growth opportunity

The agency is responsible for developing these projects as part of the country’s Nationally Determined Contributions (NDCs). It releases tenders for selection of RE developers for establishment of solar projects and other RE projects on pan-India or state-specific bases. The selection process for successful bidders is conducted by following a tariff-based competitive e-bidding procedure.

Once a bidder is selected, SECI enters into a 25-year Power Purchase Agreement (PPA) with it for procurement of power.

Further, SECI also establishes back-to-back 25-year Power Sale Agreements (PSA) with the electricity distribution companies or buying entities for sale of the procured power from the chosen developers.

The agency signs PSAs at a fixed trading margin of 7 paise per unit, which is its revenue stream. For instance, if the discovered tariff under the bidding process is Rs 2.5 per unit, SECI sells it at Rs 2.57 per unit to the discom.

“It (SECI) is a debt-free company with a growing scale because of increasing (RE) capacity. The company’s profitability has increased and it is on a strong footing,” said an analyst who did not wish to be identified.

» Read More