With the demand for upscale holidays on the rise, Oberoi Hotels and Resorts has created a pipeline of around a dozen properties, luxury boats and cruisers, which will come up in the next five years.

This fresh supply will see the addition of 1,350 keys, including about 288 outside India, starting 2026, the company said on Friday. Nine of these will be owned by EIH, the listed member of the Oberoi group, while 11 will be managed.

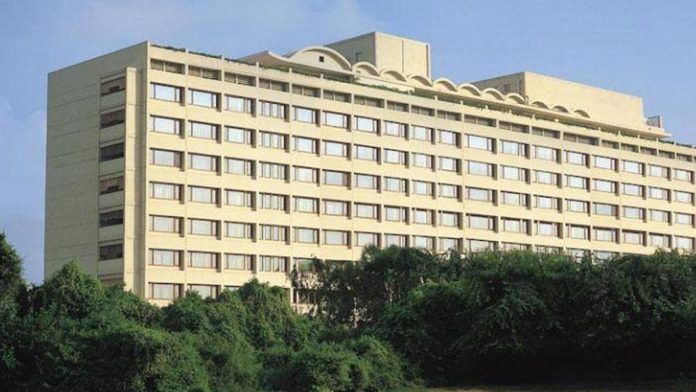

The new properties are scheduled to come up in Rajgarh (Khajuraho), Bandhavgarh, Goa, Visakhapatnam, Tirupati, Jawai (Rajasthan), Gandikota (Andhra Pradesh), Hebbal (Bengaluru), Pune, Bardia (Libya), Diriyah (Saudi Arabia), Kathmandu, Bhutan, and London.

Also ReadDomestic complex fertiliser makers to witness 10% dip in operating profitability this fiscal, recovery likely in next FY

A senior EIH official said that the London property will see the coming on board of a financial investor.

Vikram Oberoi, managing director and CEO, said: “The total investment is £69 million in the London property. Out of this, typically in our ventures, we look to have an equal share of debt and equity. Our objective would be to have a partnership of possibly 49% and that will further reduce EIH’s exposure to under £18 million.”

Coming up at the prime location of Mayfair, Oberoi’s London property will be the brand’s first hotel in the UK. Taj Hotels and Resorts have been operating St James Court in central London for several years.

“Having a flag in the UK will enhance our brand presence. This will be a top-end luxury hotel that will compete with the best hotels in London,” Oberoi said on the analysts’ call.

London operates on a strong occupancy and has high rates. Rates in the UK capital in the first half of the year, as per STR data, is around £1,200 for rooms and suites. “Given that we will have a large number of suites, we expect rates to be considerably higher,” he added.

The company has 3,772 keys in India and 497 outside the country. Thanks to its premium positioning, it witnessed a 41% jump in net profit in the September quarter at the consolidated level.

Also ReadMall operators to post 10-12% revenue growth this fiscal on escalation in contractual rental, » Read More