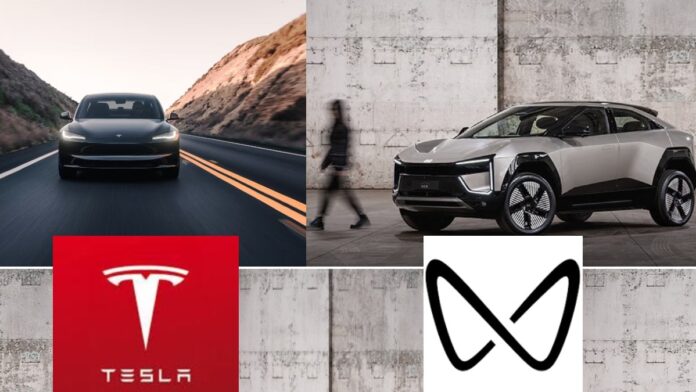

Elon Musk’s Tesla entering India markets has been one of the most talked about topic in the automotive industry. Recently there have been some reports of PM Modi keen about him setting up plant in India. However, so far in the absence of any such concrete plans, most analysts believe that Tesla’s India foray is unlikely to shake up the local automotive majors. They explained that even the cheapest Tesla model could be rather expensive, especially after import duties. This is one of the key reasons why most prefer local EV plays like M&M over Tesla. The M&M share price has been buzzing on the back of these upgrades.

Tesla’s India entry: CLSA says no big challenge for M&M, Tata Motors, Maruti Suzuki, Hyundai

CLSA believes that Tesla is unlikely to pose any significant challenge for Indian automotive majors, especially the mass market players like Maruti Suzuki, Hyundai, Tata Motors, and Mahindra & Mahindra in the near term. According to CLSA, the cheapest Tesla models would cost Rs 29 lakh approximately ($35,000) while the average price for most mass market cars are around Rs 11 lakh ($14,000). According to the brokerage houses, direct import is also unviable beacuse of the high duties- 110% for cars above $40,000 and 60% for those below $40,000.

Even if the duty on imports comes down by 15-205, the on-road price for Tesla’s Model 3 would be upwards of Rs 35 lakh. This CLSA notes would be 20-50% higher than the likes of Mahindra XUV 9e, Hyundai e-Creta and Maruti Suzuki e-Vitara.

ALSO READTesla in India: No low-cost model, no market Tesla’s India entry: Jefferies says right time to buy M&M

Jefferies to corroborates the views and sees limited impact for Indian auto majors from Tesla. The reasons include large gap in existing portfolio prices, lack of visibility on Tesla’s plans to establish local manufacturing, supply chain, charging and distribution, and EVs comprising of just 3-5% of the total volumes for key auto players like M&M. They consider the pricing of current Tesla models and import duty as key factors. According to them, even the top variants of BE-6 and XEV-9E would cost about 30-50% less than Tesla’s product offerings.

» Read More