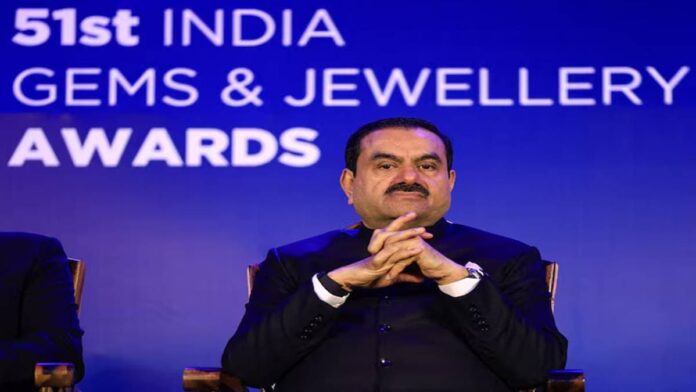

The U.S. Securities and Exchange Commission has asked Indian authorities for help in its investigation of Adani Group founder Gautam Adani and his nephew over alleged securities fraud and a $265-million bribery scheme, a court filing showed on Tuesday. The regulator told a New York district court it was making efforts to serve its complaint on the founder and his nephew, Sagar Adani, and was seeking help from India’s law ministry to do so.

Neither individual is in U.S. custody, and both are now in India. “The SEC has requested assistance … under the Hague service convention,” it said in the court filing. Adani Group and India’s law ministry did not immediately respond to a Reuters request for comment.

ALSO READAdani Green decides to ‘respectfully withdraw’ from $1 billion wind energy project in Sri Lanka

Last week, Prime Minister Narendra Modi said he did not discuss the Adani case with U.S. President Donald Trump during his visit to Washington, describing it to reporters as an individual issue never discussed by leaders. India’s opposition Congress party has called for Adani’s arrest and accused Modi of shielding him or favouring him in deals in the past. Modi’s party and Adani have denied the charges.

ALSO READGautam Adani’s renewable energy park along Pak border raises national security concerns: Report

Last year, federal prosecutors in Brooklyn unsealed an indictment accusing Adani of bribing Indian officials to convince them to buy electricity produced by Adani Green Energy , a subsidiary of his Adani Group. He then misled U.S. investors by providing reassuring information about the company’s anti-graft practices, it added.

Adani Group has called the accusations “baseless” and vowed to seek “all possible legal recourse”. In January, Adani Green said it had appointed independent law firms to review the U.S. indictment.

» Read More