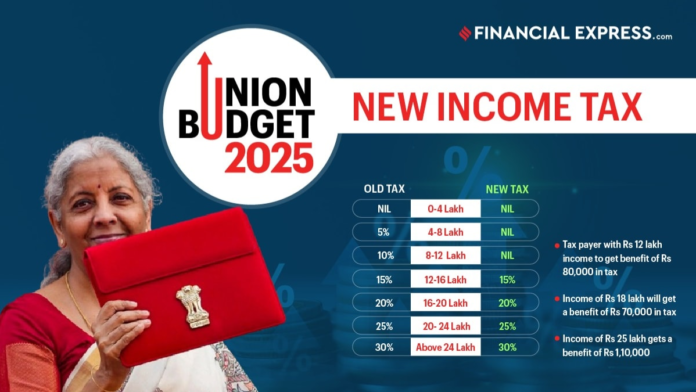

Finance Minister Nirmala Sitharaman has announced a major change in the income tax regime, offering significant relief to taxpayers. The new tax proposal, effective from Financial Year 2025-26, states that individuals earning up to Rs 12 lakh will no longer have to pay any income tax. This threshold increases to Rs 12.75 lakh for salaried individuals, due to a standard deduction of Rs 75,000.

Also ReadNew Tax Regime vs Old Tax Regime slabs and rates: Which one should salaried taxpayers choose?

This marks a significant departure from the previous tax structure, where the tax exemption limit stood at Rs 7 lakh. The revised slabs are designed to benefit middle-class taxpayers and help them retain more of their income, thereby boosting savings and investment.

Tax experts highlight that this change allows many taxpayers to retain their full earnings, especially those who opt for the new tax regime. However, it is important to note that this regime does not allow exemptions like house rent allowance (HRA) or investment rebates.

Also Read Will Budget 2025 bid farewell to the Old Tax Regime? Will Budget 2025 remove the 30% tax slab for taxpayers in India? Budget 2025: Annual income up to Rs 10 lakh to be tax-exempt? Higher deductions, new 25% slab on taxpayers’ wishlist Budget 2025: FM to introduce additional tax slab of 25% for annual income of Rs 25-30 lakh?

For salaried individuals earning Rs 12.75 lakh annually, tax experts estimate a savings of Rs 78,000 per year under the new regime, with no tax liabilities. This stands in stark contrast to the previous regime, where they would have faced a higher tax burden.

Moreover, tax experts explain that individuals earning Rs 30 lakh annually will now pay Rs 4,99,200 in taxes, a reduction of Rs 1,09,200 from the previous tax amount of Rs 6,08,400. This change makes a tangible difference in taxpayers’ financial lives, providing significant savings.

Another key shift comes with the updated 30% tax slab, now applicable to incomes above Rs 24 lakh, instead of the earlier Rs 15 lakh threshold. Tax experts emphasized that this change makes the tax system more equitable by easing the burden on high-income earners.

Also ReadBudget 2025: ‘Nil’ tax on income upto 12 lakh; Here’s how much you will pay if earning exceeds this threshold How to save tax on 25 lakhs salary? » Read More