The midcap and smallcap stocks came under heavy selling pressure on Tuesday as investors continued to take money out of equities due to concerns over faltering domestic earnings growth, and uncertain global macroeconomic scenario with geopolitical risks and China stimulus measures.

Apart from this, concerns that the US Federal Reserve may slow its rate cuts going ahead also weighed on the sentiments on Tuesday.

The BSE Smallcap index shed 3.8% and the BSE Midcap fell 2.5% on Tuesday, registering their biggest single-day drop since August 5. The selling was broad-based with the advance-decline ratio of 0.16 on the BSE – the lowest for a day in FY25.

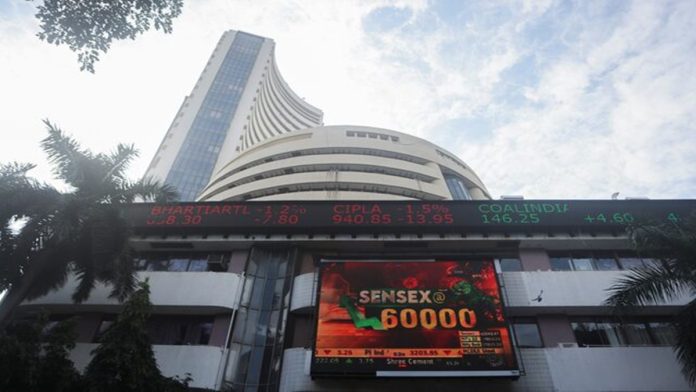

The benchmark indices too ended in the red. The Nifty 50 fell 309 points or 1.3% to close at 24,472.10 points, and the Sensex ended the day 931 points or 1.2% lower at 80,220.72 points. This is the lowest close levels for the benchmark indices as well as the broader market indices in around 2 months.

Also ReadPaytm shares slide 7.7% after Q2 results as revenue declines and one-time gain helps profit

Investor wealth worth Rs 9 trillion got wiped out on Tuesday to Rs 444.69 trillion. This marks a sharp decline from the record high of Rs 477.93 trillion hit late last month.

The Sensex is down nearly 5% so far this month, while the broader market indices are down 6-7%. Market participants do not expect a rebound rally any time soon given the underlying concerns over earnings growth and foreign portfolio investors (FPI) sell-off.

The FPIs sold shares worth Rs 3,978.61 crore on Tuesday, as per provisional data. This is on top of Rs 76,418 crore ($9.1 billion) that they have already sold this month. This excludes the data for October 21 when there were inflows due to Hyundai Motor India’s public issue.

The shift in focus towards China on the back of stimulus measures to revive the economy have led to global funds flowing to China in the face of cheaper valuations.

“There is clear evidence of a fundamental shift in policy thinking. As for markets, many Asian investors remain cautious on China, despite it trading at a heavy discount to both emerging market and global stocks.

» Read More