The Elan Group has secured an investment of Rs 1,200 crore from Kotak Real Estate Fund. The investment will be utilized as growth capital, enabling the Elan Group to further strengthen its presence in Gurugram’s prime real estate market. This investment marks a notable financial boost for the Gurugram-headquartered developer as it continues to expand its portfolio of commercial and residential projects in the region.

Commenting on this, Akash Kapoor, Director, Elan Group, said, “We are thrilled to join hands with Kotak Real Estate Fund, reflecting our shared commitment to innovation and excellence in the real estate sector. This investment marks a pivotal moment in our growth journey, enabling us to strengthen our footprint in Gurugram’s real estate market. With this financial boost, we will continue to build on our success and deliver exceptional real estate experiences.”

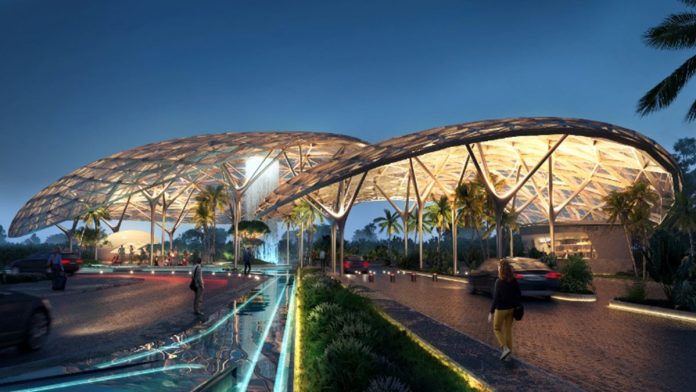

Sandeep Agarwal, CFO, Elan Group, said, “This strategic investment from Kotak Real Estate Fund reinforces our commitment to delivering world-class residential, commercial and hospitality projects. With this financial backing, we are well-positioned to fast-track our ongoing projects and embark on new, innovative developments that will further elevate the quality and scale of our offerings. The infusion of capital will allow us to push the boundaries of design and construction, ensuring that our projects not only meet but exceed the expectations of our customers.”

Also Read: NPS Calculator: How much to invest in NPS for Rs 5 lakh monthly pension? Check calculation

Vikas Chimakurthy, CEO, Kotak Real Estate Fund, said, “We are delighted to partner with the Elan Group, a company that has demonstrated tremendous growth and market potential.”

Kotak Real Estate Fund, an alternative real estate investment management practice of Kotak Alternate Asset Managers (Kotak Alts), is India’s premier real estate fund manager. Since its inception in 2005, Kotak Real Estate Fund has raised over US$ 3.5 billion across multiple Real Estate Funds focusing on diverse real estate asset classes such as residential, office, retail, hospitality, warehousing etc. making it a significant player in the alternate assets business.

» Read More