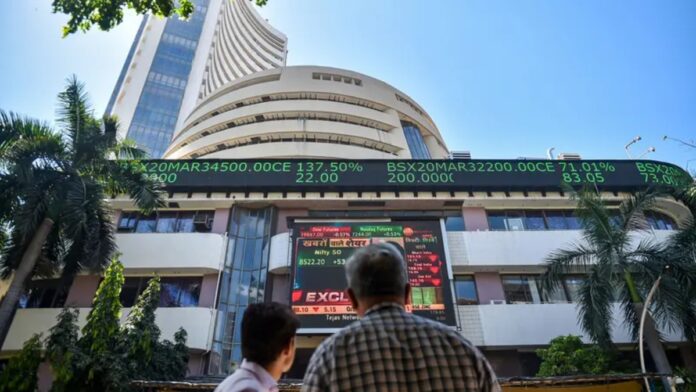

The Indian stock markets ended the final trading day of the year 2024 on a flat note on Tuesday, December 31. The Sensex dropped by 109.12 points, or 0.14%, closing at 778,139.01, while the Nifty slightly lost 0.10 points, or 0.00042%, ending at 23,644.80.

The Nifty Bank index also ended the day in the red, ending the day at 50,860.20, down by 92.55 points or 0.18 per cent.

Sensex Top Gainers

Among the 30 stocks on the Sensex pack, Kotak Bank led the pack, surging by 2.58 per cent, followed by ITC with a 1.37 per cent increase, and Ultratech Cement, up by 1.10 per cent. Tata Motors and Tata steel followed the top 5 gainers list, ending the day in green, up by 0.95 per cent and 0.88 per cent, respectively.

Sensex Top Losers

The top 5 laggards on the Sensex 30 pack included Tech Mahindra, shedding by 2.38 per cent, followed by Zomato, declining 1.73 per cent. TCS fell by 1.48 per cent, Infosys down 1.31 per cent and ICICI Bank, decreased by 0.87 per cent. The list further followed with Bajaj Finance, Hindustan Unilever, HCL Tech, IndusInd Bank and so on.

Nifty 50 Top Gainers

The top gainers on the Nifty included BEL, which surged by 2.84 per cent, followed by ONGC, up by 2.73 per cent. Kotak Bank saw a surge of 2.54 per cent. Furthermore, in the top 5 gainers Trent and Coal India posted a gain of 2.22 per cent and 1.72 per cent, respectively.

Also Read: Upcoming IPOs in 2025: LG Electronics, Zepto, Ather Energy, NSDL and 10 more IPOs on the radar

Nifty 50 Top Losers

On the other side, the top losers on the Nifty 50 were led by Adani Enterprises, declining by 2.41 per cent. The top 5 laggards list followed closely by Tech Mahindra and TCS, decreasing by 2.06 per cent and 1.27 per cent, respectively. Infosys fell by 1.07 per cent and SBI Life dropped by 0.92 per cent, closing the day on a red note.

Nifty Midcap 50 gainers

In the Nifty Midcap 50 today, gainers included APL Apollo Tubes (3.18), Aurobindo Pharma (2.87), Vodafone Idea (2.19), Oberoi Realty (2.08), Muthoot Finance (1.83).

Nifty Midcap 50 Losers

On the flip side,

» Read More