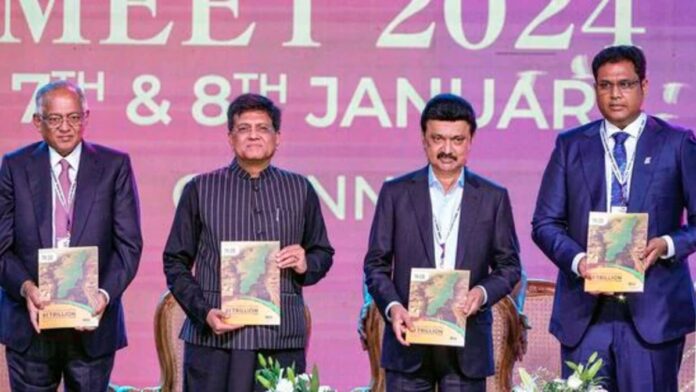

The Tamil Nadu government in 2024 took significant steps towards its goal of achieving a $1 trillion economy by 2030. It includes securing major investments and introducing sector-specific policies aimed at boosting growth. Additionally, the government focused on improving the ease of doing business and hosted its first Global Investors Meet (GIM), marking a key milestone in its economic agenda.

In 2024, a major shift occurred in Chennai’s business landscape with the acquisition of India Cements, one of the city’s major cement companies. Kumar Mangalam Birla’s UltraTech Cement, a leading player in the industry, announced the purchase of the long-established company, which had been promoted by industrialist N. Srinivasan.

Additionally, the state’s Global Investors Meet (GIM) in January 2024, resulted in investment commitments worth Rs 6.64 lakh crore from various companies, expected to create 26 lakh new jobs in Tamil Nadu.

Also Read NBFCs maintain double-digit credit growth in FY24: RBI report Investment boost! Chhattisgarh secures Rs 15,184 crore worth proposals across sectors NBFC loans: Balancing growth and risk in a changing landscape Rajasthan infra boost: PM Modi to lay foundation for 24 projects worth Rs 46,300 crore- Know all details here

Also ReadThe Intersection of AI and Human Rights: Ensuring Ethical Standards

Among the major investments secured in 2024, Vietnam-based VinFast committed Rs 16,000 crore to establish a manufacturing facility in Tuticorin, Tamil Nadu, which is expected to create around 20,000 new jobs. Additionally, Tata Motors announced a Rs 9,000 crore investment to set up a production unit for sports utility vehicles and electric vehicles in Ranipet, a move that would generate approximately 5,000 jobs in the region.

CM’s foreign visit

In 2024, Chief Minister M.K. Stalin led several high-profile delegations abroad to attract investments. Following the parliamentary elections in May, Stalin visited Europe, where he met with prominent industrial leaders in Spain and signed MoUs with major companies like ROCA and Gestamp.

Later, during his trip to the United States, he engaged with representatives from 18 Fortune 500 companies. The visit resulted in 19 MoUs, totaling Rs 7,618 crore in investment commitments, expected to generate 12,000 new jobs in Tamil Nadu.

Mini-TIDEL Parks to Boost IT Growth

As part of its ‘distributed growth’ strategy,

» Read More