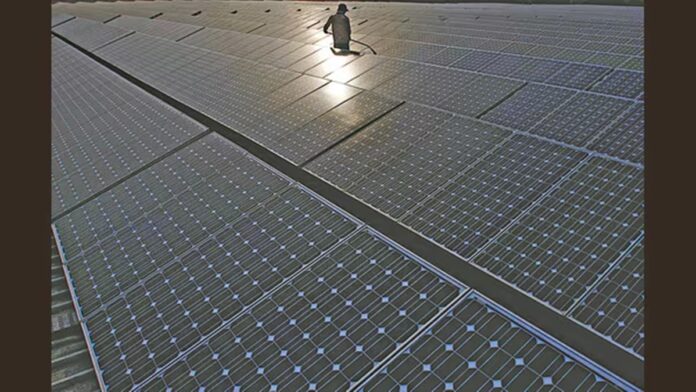

Indus Towers on Friday announced that it has entered into a Power Purchase Agreement with JSW Green Energy Eight Limited, a special purpose vehicle (SPV), for the procurement of renewable energy from Solar PV plant, under Captive mode. Under this agreement, the company will enter into an agreement for a proposed investment of approximately Rs 38.03 crore.

In a regulatory filing, the company said, “In connection with this, the company will also enter into an agreement for a proposed investment of approximately Rs 38.03 crore, through the subscription to equity shares of the SPV, in accordance with the provisions of the Electricity Act, 2003, the Indian Electricity Rules, 2005, Electricity (Promoting Renewable Energy Through Green Energy Open Access) Rules, 2022 and amendments thereof.”

Also ReadAfter tepid H1, realtors eye more launches, new cities to boost bookings

Indus Towers said that under this agreement, the company will receive 130 MW renewable energy from the Solar PV power plant. This acquisition aligns with the company’s renewable energy objectives, supporting the procurement of sustainable energy and advancing its Net Zero goals.

This acquisition will result in a 26 per cent ownership stake of Indus Towers in the SPV.

Shares of Indus Towers fell as much as 2.5 per cent to an intra-day low of Rs 335.35.

Earlier this month, Vodafone Group had announced plans to divest its remaining three per cent stake in Indus Towers. The sale, comprising 79.2 million shares, will be conducted through an accelerated book build offering, the company had revealed.

» Read More