A social media post has gone viral, claiming that the retirement age for central government employees has been increased to 62. But how accurate is this claim? Has the government really raised the retirement age for its staff? Let’s fact-check this claim.

Before diving into the details of the social media post, it is important to clarify that the current retirement age for both central and state government employees is 60 years.

What does the social media post claim about the retirement age for central government employees?

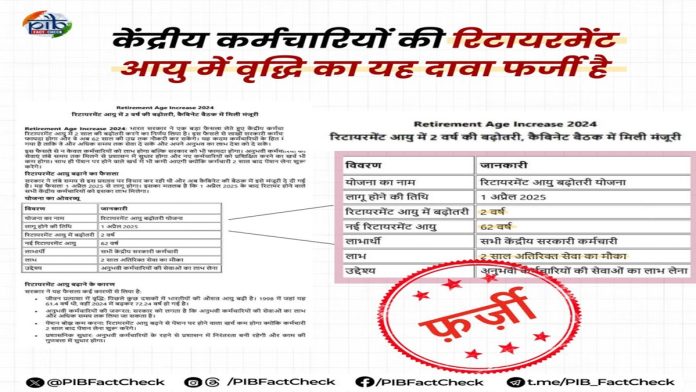

The viral message claims that the Union Cabinet has approved a rise in the retirement age for central government employees to 62, effective from April 1, 2025. The post also lists reasons against this decision, claiming that the government has made this move because life expectancy in the country has increased and there is a need for experienced personnel for national progress. Furthermore, the post suggests that the Centre intends to control the growing pension burden, and that raising the retirement age will help in improving administrative reforms.

Also read: Centre to restore Old Pension Scheme for central govt employees? Key highlights from massive OPS rally

PIB Fact Check

The Press Information Bureau’s (PIB) fact-check unit busted the fake social media post’s claims. In a statement on social media platform ‘X’, it termed the claim as fake.

“A news going viral on social media is claiming that the Government of India has decided to increase the retirement age of central government employees by 2 years,” it said.

Readers must note that if you come across any such suspicious message, you can check its authenticity. For that, readers may send the message to https://factcheck.pib.gov.in. They can also send a WhatsApp message to +918799711259 for fact check. Message can also be sent to pibfactcheck@gmail.com. The fact check information is also available on https://pib.gov.in.

» Read More