PM JAY portal, Ayushman Card eligibility criteria featured among top searches on Google Trends this week as netizens tried to get their queries related to Ayushman Bharat answered on Internet. Google searches related to Pradhan Mantri Jan Arogya Yojana (PM JAY) have risen in the wake of PM Narendra Modi launching health coverage for senior citizens of 70 years and above under the Ayushman Bharat scheme.

What is PM JAY?

Pradhan Mantri Jan Arogya Yojana is a pioneering initiative of the central government to ensure that poor and vulnerable population is provided health cover. This initiative is part of the government’s vision to ensure that its citizens – especially the poor and vulnerable groups have universal access to good quality hospital services without anyone having to face financial hardship as a consequence of using health services.

Image: Google Trends screenshot

PM JAY enrolment: Over 10 lakh senior citizens aged above 70 enrolled

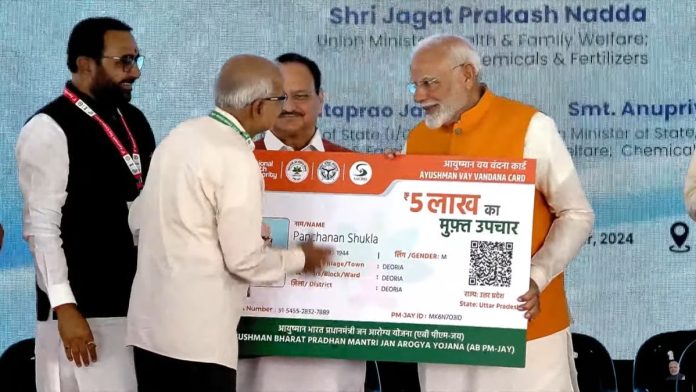

In a significant milestone, more than 10 lakh senior citizens aged 70 and above have enrolled for the newly launched Ayushman Vay Vandana Card, enabling them to access free healthcare benefits under the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY).

This achievement comes within three weeks of the card’s rollout by PM Modi on October 29. Around 4 lakh enrolments under Ayushman Vay Vandana Card are by females.

Since the launch of the Ayushman Vay Vandana Card, treatments worth over Rs 9 crore have been authorized, benefiting more than 4,800 senior citizens aged 70 and above, including over 1,400 women. These treatments cover a range of conditions, including coronary angioplasty, hip fractures/replacement, gallbladder removal, cataract surgery, prostate resection, and stroke, among others.

Also read: Ayushman Bharat PMJAY 2024: PM Modi launches health cover for senior citizens above 70 years

Ayushman Card eligibility criteria

Beneficiaries eligible under the scheme can create their Ayushman card at any time i.e. throughout the year. Eligible beneficiaries can either create the card themselves using Ayushman App or visit the nearest CSC or empanelled hospital to create their Ayushman card.

New Distinct Card: Eligible senior citizens aged 70 and above are being provided a new, distinct card under the AB PM-JAY scheme.

Top-Up Coverage: Senior citizens within families already covered by AB PM-JAY will receive an additional top-up cover of up to Rs 5 lakh per year.

» Read More