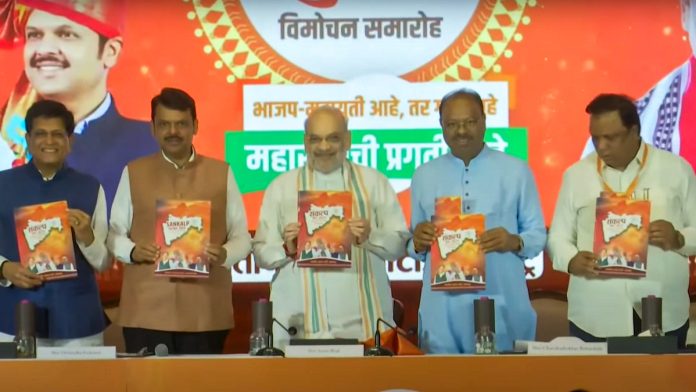

BJP releases manifesto for Maharashtra Elections: Union Home Minister Amit Shah in Sunday unveiled the BJP’s manifesto ‘Sankalp Patra’ for the upcoming Maharashtra Assembly elections, promising to create 25 lakh jobs for the state’s youth over the next five years. He also announced plans to increase the Ladki Bahin Yojna allowance from Rs 1,500 to Rs 2,100 and pledged a loan waiver for farmers. Describing the manifesto as a blueprint for Maharashtra’s development, Deputy Chief Minister Devendra Fadnavis said that the BJP’s vision is to create a “Viksit Maharashtra for Viksit Bharat.” With just 12 days remaining until the Assembly polls, the political battle between the Mahayuti (BJP-led alliance) and the Maha Vikas Aghadi (opposition coalition) is entering its final stages.

#WATCH | Union Home Minister Amit Shah launches BJP’s ‘Sankalp Patra’ for #MaharashtraAssemblyElections2024, in Mumbai.

Deputy CM Devendra Fadnavis, state BJP chief Chandrashekhar Bawankule, Mumbai BJP chief Ashish Shelar, Union Minister Piyush Goyal and other leaders of the… pic.twitter.com/F6pXK2eDQH

— ANI (@ANI) November 10, 2024

A

Also Read Donald Trump calls oil liquid gold, says US has adequate supply and “China doesn’t have what we have” – Crude falls 1.5% US Election Results 2024 Highlights: Will President-elect Donald Trump help resolve India-Canada relations? Swiggy IPO Highlights: Issue got subscribed 12% on Day 01 Elections 2024: ECI reschedules bypolls in 14 Assembly constituencies across Kerala, Punjab and Uttar Pradesh

BJP’s Poll Promises:

Skill Census: A comprehensive skill census will be conducted to evaluate the demand and supply of jobs in the private sector, aiming to create more employment opportunities.

Lakhpati Didi Scheme Expansion: The BJP plans to extend the “Lakhpati Didi” scheme, which currently benefits 11 lakh women, to 50 lakh women, empowering them financially.

Fertilizer GST Refund: Farmers will receive a refund of the GST paid on fertilizers, easing their financial burden.

Interest-Free Loans for Industry Growth: The government will offer zero-interest loans up to Rs 25 lakh to boost industrial development.

Increased Pension for Senior Citizens: The monthly pension for elderly citizens will be increased from Rs 1,500 to Rs 2,100 to provide better financial support.

Farm Loan Waivers: Farmers will benefit from loan waivers to alleviate their debt burdens and support agricultural growth.

» Read More