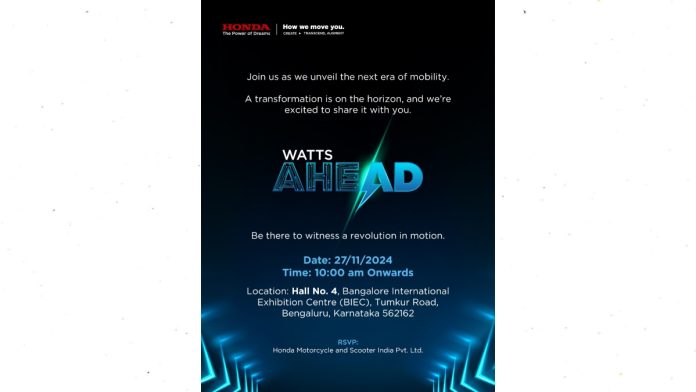

After much anticipation and many rumours, Honda is finally set to unveil the all-electric Activa in November 27. Going by reports, the electric Activa will offer the same performance as its IVE counterpart and will be the company’s first electric offering in India. Here’s more on the Honda Activa electric.

Honda Activa electric — What to expect?

The all-electric Activa has been under development for a while now and will use the same Activa platform, however, the chassis will see some modifications to accommodate the battery pack. This will help Honda keep costs in check and also help with mass production without extra investment.

Also ReadHonda to launch its e-scooter this month— Activa electric on cards?

In terms of performance, there are no details about the battery pack yet, but expect the performance to be similar to the ICE Activa with a range of around 100km. The electric Honda Activa is expected to get telescopic front forks, disc brakes, and an all-digital instrument cluster with phone connectivity. Expect the electric Activa to also offer a larger boot compared to the ICE version.

Honda Activa electric — Competition

Honda is late to the party, as most its competitors in the market such as Hero MotoCorp, TVS, and Bajaj have established themselves in the EV space. So, the competition to the electric Activa is not only from them, but also from startups in the space like Ather and Ola. More details will be known on the 27th of November, so stay tuned.

» Read More