By Meet Kapadia

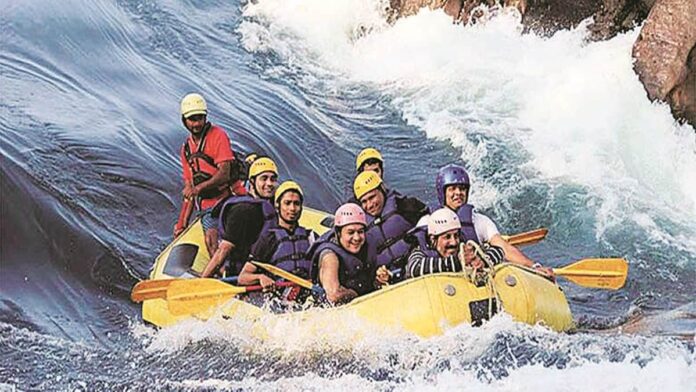

Think of rafting down a churning river or skiing down a slope and suddenly facing something untoward. Regular medical and travel insurance often does not cover these high-risk pursuits. Activities like rafting, paragliding, bungee jumping and mountaineering usually belong into a “hazardous sports” bucket, which is typically excluded unless specifically opted for.

Securing this protection is easy and inexpensive. The cost of the add-on when compared to the out-of-pocket burden of treatment or evacuation is minuscule. In India, riders for adventure sports can be added for as little as a starting price of `89 onwards, extending coverage to injuries or even fatalities arising during such activities.

ALSO READInsurance surety bonds for NHAI contracts cross Rs 10,000 crore The fine print

Standard travel insurance is designed for common mishaps like lost baggage, delayed flights or sudden illness. The economics of risk are clear: adventure activities carry higher probability of accidents and costlier claims, which is why they sit outside base policies.

Take scuba diving, trekking above 3,000 metres, or white-water rafting, which many policies list explicitly in their exclusions. This can lead to shock at time of claim. Even among comprehensive international travel covers, exclusions around “hazardous sports” are common, leaving tourists vulnerable despite paying for insurance.

This gap is not theoretical. According to industry reports, medical evacuation from remote areas can cost up to Rs 20 lakh depending on location and severity. Needless to say, the treatment abroad multiplies that figure. Without the right rider, the entire cost falls on the traveller.

Some policies also differentiate between “soft adventure” (snorkelling, cycling, or camel rides) and “extreme adventure” (skydiving, bungee jumping, mountaineering). For instance, some riders offer a dedicated adventure sports rider covering injuries during such activities, though with age restrictions and activity-specific limits. So, unless a high-risk activity is named in the cover, best to assume it is excluded.

Paying a little extra

One reason many skip adventure riders is the perception that insurance costs are already high. But this is far from the truth. Premiums for a two-week international trip can range from Rs 600 to Rs 3,000 depending on coverage. Adding an adventure sports rider nudges the premium slightly higher.

This marginal cost shields against financial hits that can run into tens of lakhs.

» Read More