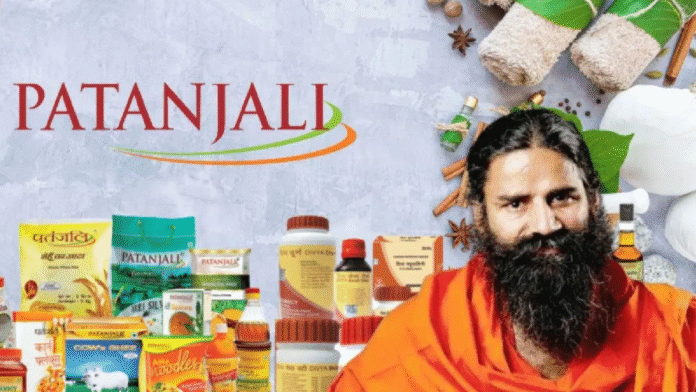

Patanjali Ayurved, the company founded by yoga guru Ramdev, has come under fresh scrutiny from the Ministry of Corporate Affairs (MCA), which has issued a notice seeking an explanation over a series of financial transactions flagged as suspicious by federal economic intelligence agencies. A report by Bloomberg reveals that the government is probing possible fund diversion and violations of corporate governance norms within the company.

ALSO READChidambaram flags alarming trend of investment cancellations by Indian companies; calls out Finance Ministry

According to sources, the flagged transactions were deemed “abnormal and dubious” by agencies, although specific financial details have not been disclosed as the investigation is still in its early stages. Patanjali has been given approximately two months to respond to the government’s notice.

This development adds to the list of regulatory challenges facing Patanjali Ayurved and its various subsidiaries. The company has previously come under the scanner for alleged tax violations and wrongful GST refund claims. Last year, one of its units received show-cause notices from tax authorities.

Patanjali has also faced legal trouble over its advertising practices. It drew widespread criticism for airing misleading ads that claimed to offer cures for serious diseases such as cancer. The Supreme Court of India recently barred the company from making such claims, citing violations under the Drugs and Magic Remedies (Objectionable Advertisements) Act, 1954.

In February 2025, the Kerala Drugs Control Department reported 26 active legal cases against Ramdev and Patanjali across various courts in the state, related to the same law. Several newspapers that published the controversial ads are also facing legal proceedings.

ALSO READMMRDA tells SC, both tenders worth Rs 14,000 cr to be scrapped; Maha govt to take a call

Though Patanjali Ayurved remains a privately held firm, its listed subsidiary, Patanjali Foods Ltd, has not escaped the fallout. The company’s shares have plunged nearly 10% so far this month amid growing regulatory pressure.

» Read More